AMD beats Q2 projections, stock rises 4% in after-hours trading

AMD shares rise in after-hours trading following the graphics card maker’s second quarter results, as its revenue and earnings both beat expectations. The company’s new Instinct Accelerator programs are helping to drive growth, alongside increased AI engagement.

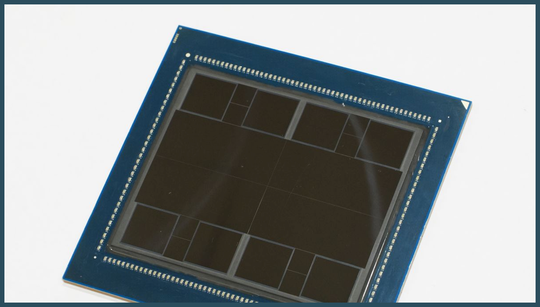

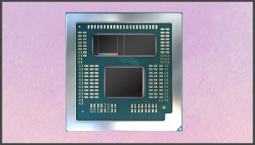

The company says that both the MI300A and MI300X are on track for Q4 launch, and will likely represent a significant challenge to Nvidia. AMD says that its consumer chips revenue is down 54%, but that the Zen 4 Ryzen 7000 processor sales are helping to drive growth in the company’s gaming segment.

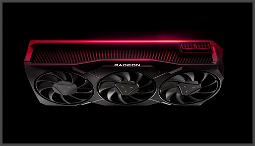

AMD’s revenue is at $5.4 billion, down 18% YoY, but the company says that the PC market is improving. On the other hand, consumer chips are down 54%, with chief financial officer Thomas Seufert saying that this was driven by a lack of sales for the company’s Radeon products.

Gaming segment revenue is at $1.6 billion, with Seufert saying that AMD’s lower GPU sales are what’s causing the slump in this area. Data center revenue is down 11%, with the company saying that the weak market is impacting the sale of its third-gen EPYC Milan products.

However, the fourth-gen EPYC Genoa models are helping to offset this decline, and the data center group posts $147 million in operating income. Seufert says that the company expects fourth-gen EPYC growth to be “slightly higher than double-digits” in the next quarter.

With the company continuing to push its China-optimized AI products in light of the US’s new trade sanctions against China, there seems to be a lot of potential for AMD to grow in this area.

Q3 guidance

AMD’s guidance for Q3 is as follows:

Check out the best graphics card you can buy right now, for your favourite PC games.