Chip-on-wafer-on-substrate packaging boosts performance and cuts costs

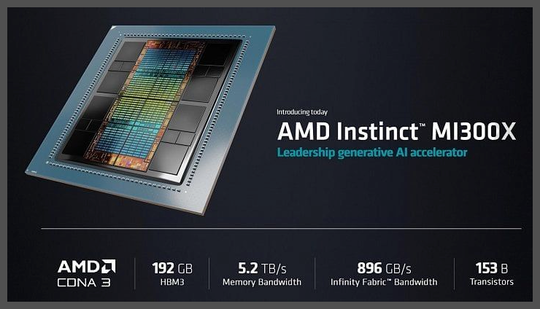

Chip-on-wafer-on-substrate packaging will help both AMD and Nvidia boost their graphics cards and processors, thanks to a TSMC tool boost. The foundry's decision to increase the number of tools available should help the Taiwan-based company meet growing demand for AMD's MI300-series GPUs and APUs, and it could also lead to improved Nvidia RTX and Nvidia GX cards in the future.

According to TSMC, the foundry's customers that use CoWoS packaging will account for one-third of total GPU shipments in 2023, and that percentage will rise to half in 2024. In terms of specific companies, TSMC says it expects AMD's MI300-series to account for half of Nvidia's CoWoS-equipped GPU shipments.

"We believe the attach rate for CoWoS is much higher for AMD's GPUs than for Nvidia's," Jefferies analyst Mark Lipacis says. "We expect an attach rate of 60% to 65% for AMD versus 40% to 45% for Nvidia."

This is partially because AMD's compute GPU demand is a bit more optimistic than it might seem on the surface. Nvidia controls 90% of the market, so it's easy to assume that AMD is going to be eating into a massive pie. However, AMD says that it is targeting the high-end segment, which is where the RTX cards live.

In fact, it's possible that AMD could actually boost Nvidia's attach rate if the MI300-series ends up being a better high-end offering than the RTX cards. It's still too early to say whether this will be the case, but the fact that AMD is targeting the same space as Nvidia could lead to some interesting dynamics.

Apic Yamada, Disco, Gudeng Precision Industrial, and Scientech are among companies that TSMC has ordered advanced packaging equipment from. Lead time for tools is less than six months, according to China Renaissance Securities.

Amazon, Broadcom, and Xilinx also use CoWoS packaging for data centers, but the technology will likely become more ubiquitous as time goes on. It's crucial to AMD's future products, as well as Nvidia's compute GPUs.

In fact, TSMC plans to increase CoWoS capacity from 8,000 to 11,000 wafers monthly by 2023, then to 14,500 to 16,600 wafers monthly by 2024. That's well beyond Nvidia's current capacity, which is thought to be somewhere around 20,000 wafers monthly.

While it's true that capacity is only one part of the equation, it's certainly another factor that could give AMD an edge. After all, the company is already boasting about high customer interest in the MI300-series, but it's also seen its stock fall due to doubts over its AI goals.

Meanwhile, Nvidia's stock is up almost 18% over the last five years, and it's gained 2% in the last month alone. Analysts clearly have a lot of confidence in the company, even if they're expressing concerns over AMD's optimism in terms of AI.