A China-made chip scanner could arrive by the end of 2023

Shanghai Micro Electronics Equipment Group (SMEE) is planning to produce a 28nm lithography machine that could mark a significant step in developing self-reliant chip manufacturing in China. SMEE, previously China’s only potential competitor to ASML, the leading lithography machine maker, is expected to unveil its homegrown scanner as it seeks to expand its business abroad following its $3.5 billion initial public offering (IPO) in New York last year.

The move could help China reduce its reliance on foreign wafer fab equipment, with major Chinese chipmakers currently using gear made abroad due to restrictions imposed by the US, Japan, and the Netherlands.

SMEE's Plans

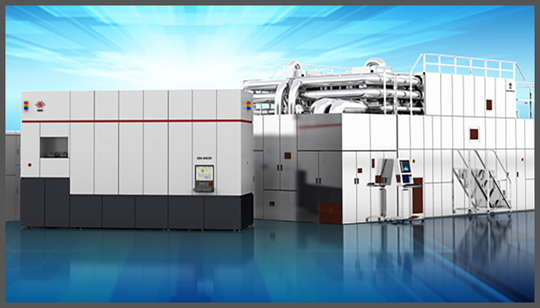

Founded in 2002, SMEE has become China’s leading lithography machine maker, and the company recently said it plans to introduce the domestically produced SSA/800-10W lithography machine, which would be a significant achievement.

However, SMEE has not made any machines yet, and the company’s ability to produce these machines at scale remains uncertain. Major Chinese chipmakers currently rely on equipment made abroad due to the aforementioned export restrictions.

For instance, China’s top foundry SMIC and Hua Hong Semiconductor, the country’s No. 4 chipmaker, purchase 28nm-capable tools from abroad. The emergence of a local scanner would be more cost-effective and allow SMEE to leapfrog several generations of scanners.

“A locally developed scanner is a big deal for China’s chipmakers,” said Robert Lin, a senior analyst at research firm IHS Markit. “It will allow local companies to develop their own fab equipment and reduce their reliance on overseas equipment providers like ASML.”

In its IPO prospectus, SMIC said the presence of foreign fab equipment would create risks for its business and that it needed to “actively respond to the challenges arising from the use of foreign fab equipment.”

The Impact on ASML

A local scanner would also allow SMEE to compete against ASML in the scanner market, which Lin said could be a “real threat” to the Dutch company.

While a China-made scanner will likely boost SMEE’s sales, the company’s shares are still trading at a significant discount to its IPO price of $19. (This is partly due to the broader market turmoil, with the Dow Jones Industrial Average falling by more than -3% since the SMEE IPO.)

Nevertheless, the company’s stock is likely to benefit from any positive news, including the scanner announcement. Optical components manufacturers in China, including Mloptic, Kingsemi, and Castech, which have been supplying SMEE with components for its scanners, will also likely see a boost in their stocks.

However, Lin said there are still uncertainties regarding SMEE’s ability to produce these machines at scale. As a result, there could be some delay in the release of the SSA/800-10W.

“Major Chinese chipmakers are currently using equipment developed by ASML and Nikon,” Lin said. “If SMEE is able to produce a scanner that offers competitive pricing, it would be a major threat to those companies.”